Crypto, Web3 and narrative gravity

Introduction

This is the first in a planned series of posts that sets context for and introduces a hopeful path towards the creation of Network Public Service Media, as a necessary and vital balancing force to the internet’s dominant media business models.

Following posts will establish the underlying concepts of Network Publics and their emerging economic, organisational and cultural architecture and processes.

This series is part of ongoing applied research & development funded by Edgeware’s decentralised public innovation fund and advanced through Kabocha’s soon to launch on-chain identity, IP and rights management project that has recently secured a parachain slot on Kusama.

Setting the stage

Currently creators produce content to grow audiences and then sustain their work by extracting value from fans, directly and indirectly, through advertiser funding, product endorsements and subscription revenues.

The most influential of all create their own product lines and launch their own platforms.

Most recently NFT sales have become a new tool in the influencers monetisation mix.

If we make a good faith assumption that people are inherently good, but are pushed into decisions that do not align with their core values by environmental factors - the system of incentives they are subjected to, then we can reason that creators are primarily driven initially by their desire to create - and in turn share their passion and unique talents with others.

The previously mentioned business models exist to turn creators into influencers, but none aligns the best interests of the creator and their fans over the long term.

As scale increases, perverse incentives compound and a creator’s primary motivation, or indeed that of their associated corporate interests shifts towards consistently transforming personal relationships into transactional ones.

In psychology this kind of behaviour is known as sociopathic - from the Latin socius for society and pathos suffering, equated to “suffering in society”.

Without a balancing force, the current dominant model encourages a privatised and profiteering culture that ultimately inspires a toxic mix of clickbait content, talent burn out, mental health epidemics and an ever increasing concentration of wealth and power that steadily and inexorably corrodes the fabric of civil society.

At the same time, established institutions of media already struggling to adapt to this new and maximally extractive networked era are driven to make commercial decisions that further compromise their core values, which further compounds the crisis in trust and adds to the chaos and confusion.

As tensions rise, all positions become radicalised and sense-making becomes increasingly difficult - an unfortunate but predictable externality for a media model that is sustained through deeply misaligned incentives where the boundless wonder, beauty and potential of human existence is reduced to data in a spreadsheet to be commoditised, priced and traded by the market.

Blockchain and the media

Crypto-currencies such as Bitcoin, Ethereum and Polkadot were created by visionaries who hoped to offer an escape from the crushing gravity of central banks, Wall Street and tech monopolies respectively.

Whilst each engineered solutions that advanced the capabilities of software to establish and transact value in peer to peer networks, their adoption and subsequent narratives were each co-opted and then dictated by a media ecosystem whose core incentives steadily usurped the revolutionary ideals of the founders.

Bitcoin’s narrative

With a solution to the double spend problem, it was no coincidence that Bitcoin’s successful proof of concept attracted many revolutionaries, since the technological advance offered a chance to create true digital scarcity, without the need for a trusted intermediary, thus offering a chance to create entirely new systems for coordinating humans from the ground up.

Between 2009 and 2012 Bitcoin’s media ecosystem consisted primarily of mailing lists and forums which were not yet being monetised as social media was still in its infancy.

Some early holders understood that the story needed to be shared and in 2012 Vitalik co-founded Bitcoin magazine, followed by CoinDesk in 2013 which is now owned by Digital Currency Group.

Slowly but surely large holders of Bitcoin who understood the power of storytelling began to acquire and consolidate publishers, gradually expanding distribution, influence and exerting narrative control over the project.

Bitcoin’s revolutionary potential was now directly and indirectly shaped by media special interests, whose business models were no different than the status quo they claimed to replace.

With no transparent system for sustainably funding media that aligned the interests of the network’s participants, number go up became the primary schelling point for anyone assessing the progress of the technology.

The fixed supply of 21 million - never a core part of Satoshi’s narrative, evolved into the primary marketing message, with “digital gold” its banner slogan and a rush for institutional credibility the north star for adoption, aka NGU.

Stories of overnight millionaires, concerns about criminal activity and whiplash volatility meshed perfectly with the tech companies expanding quest for attention and the primal dopamine instincts of the monkeys now endlessly refreshing their mobile phones.

And so it was that the true impact of a revolutionary technology was lost in a sea of noise as the unification of economic speculation, social media and unregulated advertising across borderless, 24/7 networks set the scene for Bitcoin’s primetime moment.

Ethereum’s smart contracts

Vitalik Buterin designed Ethereum to expand Bitcoin’s underlying capabilities as outlined in the whitepaper:

Satoshi Nakamoto's development of Bitcoin in 2009 has often been hailed as a radical development in money and currency, being the first example of a digital asset which simultaneously has no backing or "intrinsic value" and no centralized issuer or controller.

However, another, arguably more important, part of the Bitcoin experiment is the underlying blockchain technology as a tool of distributed consensus, and attention is rapidly starting to shift to this other aspect of Bitcoin.

Commonly cited alternative applications of blockchain technology include using on-blockchain digital assets to represent custom currencies and financial instruments ("colored coins"), the ownership of an underlying physical device ("smart property"), non-fungible assets such as domain names ("Namecoin"), as well as more complex applications involving having digital assets being directly controlled by a piece of code implementing arbitrary rules ("smart contracts") or even blockchain-based "decentralized autonomous organizations" (DAOs).

What Ethereum intends to provide is a blockchain with a built-in fully fledged Turing-complete programming language that can be used to create "contracts" that can be used to encode arbitrary state transition functions, allowing users to create any of the systems described above, as well as many others that we have not yet imagined, simply by writing up the logic in a few lines of code.

Eight years after its launch, Vitalik’s design for Ethereum has been a wild success when it comes to delivering against the original intentions. The network has a current market cap of $295 billion and thousands of developers programming on the platform.

Despite Vitalik’s undoubted desire for the project to be a force for good, it is, like Bitcoin, trapped in a system of incentives beyond his control - namely the digital media ecosystem, which continues to exact its own systemic gravity on Ethereum’s roadmap.

Slowly at first, then with increasing speed the incentive cycles kick into gear, exerting a narrative force that bends its vast ecosystem of builders, creators and investors inexorably away from Vitalik’s hopes of creating foundations for fairer voting systems, urban planning, universal basic income and public-works projects and towards Wall Street meets Las Vegas in the cloud.

Just as Bitcoin had a slow start followed by explosive price moves as establishment and upstart media caught hold of this weird internet money, so the mainstreaming of Ethereum’s existence were once again dictated by major headlines such the original DAO exploit and then the introduction of ICOs, that were in effect digital marketing campaigns, with a token attached.

The combination of Silicon Valley Kool-Aid and savvy digital marketeers, matched to the nascent artistic verve of token economists created conditions for a giant speculative bubble where practically nothing of value was created, save more mechanisms for relieving newcomers of their hard earned money.

The most recent and perhaps most blatant example of this systemic co-dependence between crypto and the media industrial complex is Bored Ape Yacht Club by Yuga Labs.

BAYC is an NFT project whose initial 10,000 mint of apes has gone on to become the biggest story of the year, raising hundreds of millions from investors, before selling land in its upcoming metaverse ‘Otherside’ for $500m plus.

The founders outline the origin story in this New Yorker article:

The year is 2031. The people who invested in the early days of cryptocurrency have all become billionaires. “Now they’re just fucking bored. What do you do now that you’re wealthy beyond your wildest dreams?” Goner said. “You’re going to hang out in a swamp club with a bunch of apes and get weird.” Why apes? In crypto parlance, buying into a new currency or N.F.T. with abandon, risking a significant amount of money, is called “aping in.” “We also just like apes,”

Whilst the founders were up front about the speculative crypto-culture their project was riding on, the behind the scenes story is less well understood, but serves to highlight how the crypto industry and the media industry continue to walk in lockstep.

Let’s start with this deeply weird Paris Hilton and Jimmy Fallon interview which is introduced by Max Read, in his article Mapping the Celebrity NFT complex

Fallon and Hilton are only two of the many celebrities who have purchased BAYC NFTs: Gwyneth Paltrow, Logan Paul, Eminem, and the dreaded Chainsmokers all own apes. Justin Bieber has one, though the precise purchase mechanism and ownership of his is somewhat unclear. Other celebrities have gotten into different NFT collections: Reese Witherspoon, for example, is a collector and promoter of the "World of Women" NFT collection, which Gus Wenner's Rolling Stone tells me is "cracking crypto's boys-cub image." (Witherspoon is, overall, an apparently intense enthusiast for the blockchain-based "web3" vision of the future of the internet, in which NFTs are predicted to play a prominent role.)

Whilst Bored Apes may be marketed as a ‘Web3 revolution’, they are in fact reassuringly familiar - a very well executed influencer campaign pulled together by well networked advertising and media executives, publishers, talent and investors:

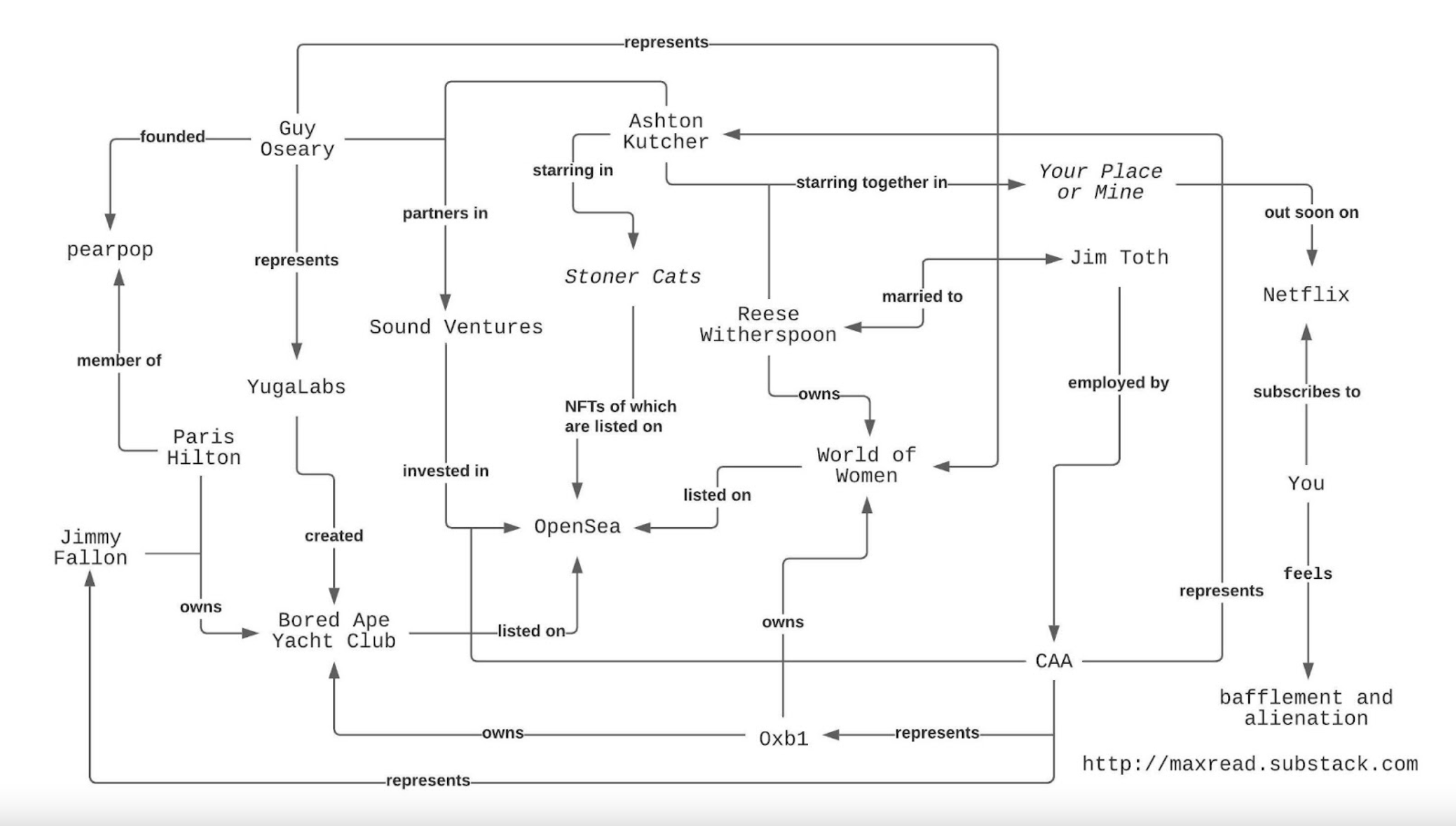

If you pay attention to both the Hollywood trades and the crypto press, and smoke enough weed, you can begin to pick out the contours of an expanding, interconnected, celebrity-based web3 financial-cultural complex: Did you know, for example, that Jimmy Fallon is represented by CAA, which is an investor in the NFT marketplace OpenSea, and which recently signed a deal to represent the NFT collector 0xb1, who owns NFTs from Bored Ape Yacht Club and World of Women? Did you know that another CAA client, Ashton Kutcher, is also an investor in OpenSea, through his company Sound Ventures? Or that Kutcher will be starring in a Netflix romcom called Your Place or Mine with Reese Witherspoon, the most prominent owner of World of Women NFTs, who also happens to be married to a CAA agent? Or that the people behind World of Women and Bored Ape Yacht Club are both represented by Kutcher's partner in Sound Ventures, the music manager Guy Oseary? Did you know that Oseary's other major venture these days is pearpop, a platform for connecting Tiktok influencers to celebrities for collaborations — a platform used by none other than Paris Hilton?

Credit Max Read

Media and money are two sides of the same coin and even Vitalik is concerned:

“The peril is you have these $3 million monkeys and it becomes a different kind of gambling… there definitely are lots of people that are just buying yachts and Lambos.”

“If we don’t exercise our voice, the only things that get built are the things that are immediately profitable… and those are often far from what’s actually the best for the world.”

Polkadot’s ‘Web3’

The history of the term Web3 can be first tracked back to Gavin Wood, the developer who coded Vitalik’s vision for Ethereum. With no real money at stake, he did it out of simple creative curiosity - he simply wanted to see if this design could work.

After Ethereum’s issues became apparent Gavin and a small team began developing a solution that would become Polkadot and their Substrate operating system.

Polkadot is built around the concept of relay chains that offer security guarantees to parachains, enabling teams to focus on building out their core use case, rather than needing to bootstrap a decentralised network of validators.

Polkadot and Kusama, its more experimental offspring, are rooted in a multi-chain minimalist design philosophy, in contradistinction to Ethereum’s single chain maximalism, where everyone builds on the same base layer, and inherits the same design decisions and issues.

Within this framework, the sole duty of a relay chain is to ensure security for its parachain network. As a result the financial incentives are engineered to create demand for the underlying DOT and KSM tokens respectively - in the end security is the only thing they offer.

Teams wishing to access Polkadot or Kusama’s shared security must acquire and then lock up DOT or KSM on each relay, which in turn enables them to ditch their own validators and enter an environment where they can pass messages to other bonded chains.

Like a hub with spokes, the relay and parachain model, alongside the shared operating system of Substrate means all chains in this ecosystem can make transactions and arbitrary data calls in a way not possible with networks that do not share the same consensus rules.

So far so good, however almost immediately the narrative shift began as the primary mechanism for securing a slot was via something called Crowd Loans.

As a smart dodge of securities and money issuer regulations, a project team wishing to raise DOT or KSM would no longer raise funds and launch tokens directly.

Instead they would conduct a marketing campaign where they would encourage holders and investors to loan their holdings which would be used to enter an auction to win a slot in the relay.

In return for loaning their DOT or KSM, contributors would receive a new token that would only be available once the new network joined the relay chain and completed a series of steps designed to give the impression that the network was decentralised and not under the explicit direction of a founding team in the manner of a traditional startup - per prior regulatory concerns.

Like clockwork, teams launching parachains created influencer marketing campaigns with the rocket fuel of economic incentives and voila brand new communities emerged in Telegram and Discord. Whether or not these future holders believed in the viability of the team’s mission was irrelevant, what really mattered were the expected returns.

Would this parachain’s hype carry the day and give this young degen a 10,20 or dare we whisper it, a 100X?

As the networks went live, the immovable object - a visionary technologist with a multichain minimalist vision, met the unstoppable force of the advertising, influencer and media complex.

The Polkadot and Kusama relay chains are true app chains, single purpose projects that have clearly defined and communicated value capture mechanisms. However when it came to raising funds for crowd loans, the easiest thing to market to existing speculators and indeed newcomers within the confines of the existing media system was Ethereum casino clones.

Core values seemingly powerless in the face of the same misaligned media incentives..

Revolutionary technologies and get rich quick schemes

In each crypto paradigm shift, adoption has followed the same route - a brilliant proof of concept that then wandered through the media looking glass, only to see its founding values become blurred.

Bitcoin’s design unbundled central banks into peer to peer money, but then the digital gold narrative appealed to our base instincts of scarcity and greed.

Ethereum’s design unbundled the financial engineering of The City and Wall Street, but then the NFT casino came to town with social media and Hollywood in tow.

Polkadot’s design brilliantly unbundled both Bitcoin and Ethereum, by creating a blockchain building framework that was designed to hand off security concerns and enable native interoperability in the process. And yet so far the majority of projects have learned none of the lessons that were rooted in the founding multi-chain minimalism ethos.

Which brings us to the root of the problem…

Can any blockchain escape the narrative gravity of the incumbent media ecosystem?

This is the true elephant in the room when it comes to handicapping crypto’s revolutionary potential.

Not regulation, not malicious miners, not exchange hacks, but truly independent media. And yet no one talks about it, which is because it serves none of the entrenched interests to do so.

Without stepping out of the bubble and accepting this existential problem exists, there is no path forward for the crypto industry that can possibly ensure primacy of the public good. If you accept crypto simply as a short term money making exercise then it can be good honest fun - just like a casino.

If however you have been sold on crypto’s transformative capabilities for society, and in general this is how most of the marketing works, then know you are betting the family farm on a pig in lipstick, with no long term future, save accelerating and compounding the worst traits of Web2 via supercharged economic speculation.

Once this challenge is accepted and understood, then we can at least figure out what to do next. If we don’t, then the narrative gravity of the incumbent media industry will do what it does best, no matter the good intentions of those who want to enact positive social change.

You don’t need a map if you have a compass

So here we are, stepping out into the unknown. There are no maps where we are going, but we have something better, a compass that can help us plot a course towards a future where you can trust the intentions of the media you are served.

It won’t be perfect, nothing is, but it can be better than we have right now.

And if we can create a fundamentally new media model that is open and accessible to anyone with an internet connection, we can unlock stories that are not designed to indulge our worst tendencies, but rather serve to inspire a new paradigm of human endeavour - opening up a true playground of possibilities.

The journey is underway, we’re developing grass-roots solutions within the public design systems of Edgeware and Kabocha, ensuring the sustainable funding of ambitious creative projects that can share value equitably within a decentralised network of contributors whilst also guaranteeing long term incentive and values alignment through the creation of independent and trusted Network Public Service Media.

Next post in the series coming soon:

An introduction to Network Publics